Wellesley Bank has been a trusted name in the financial sector for decades, serving communities with a focus on personalized banking and relationship-building. However, recent developments have sparked questions about the bank’s operational status. Did Wellesley Bank go out of business? This comprehensive article delves into the history, transitions, and current state of Wellesley Bank while addressing concerns and rumors about its status. We’ll explore the factors behind the bank’s evolution, its acquisition, and what it means for its customers.

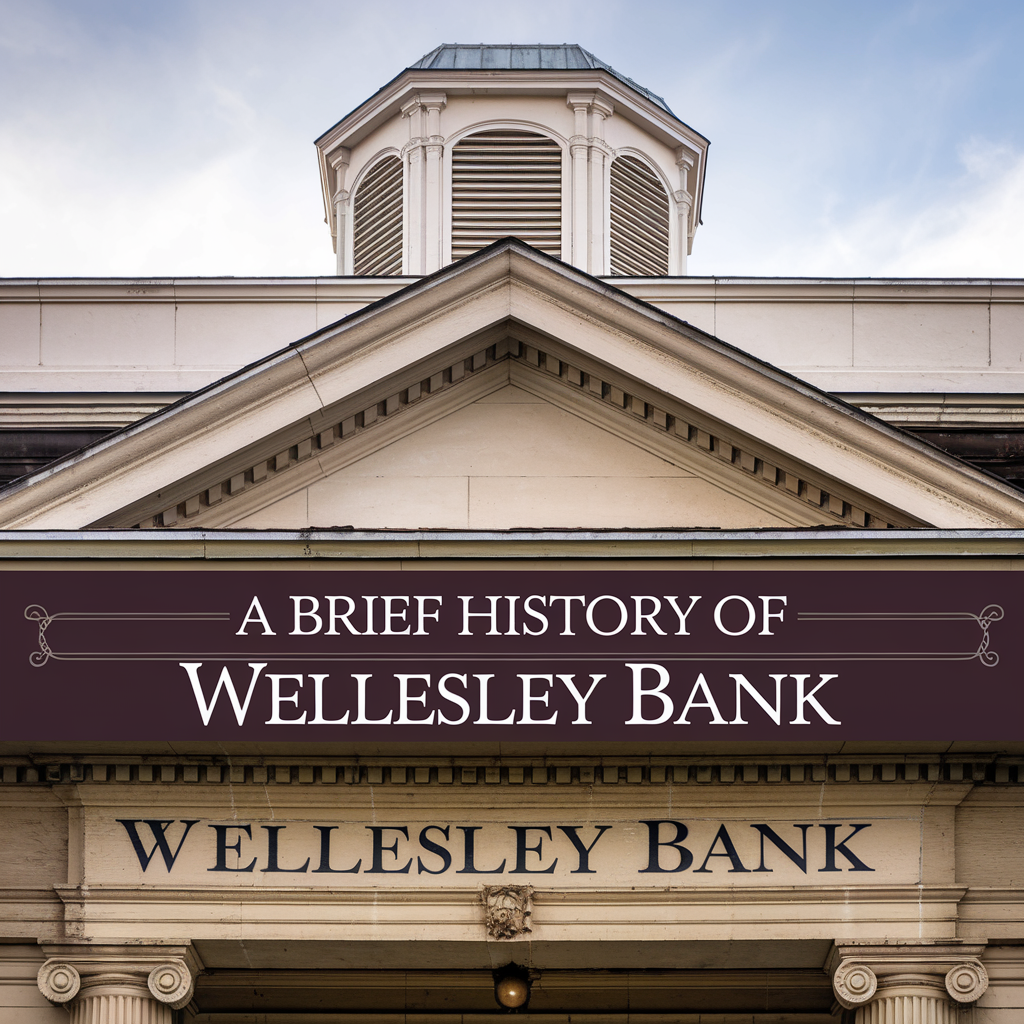

A Brief History of Wellesley Bank

Founded in 1911, Wellesley Bank began as a small community-focused bank in Wellesley, Massachusetts. It earned a reputation for personalized service, catering to the needs of individuals, families, and businesses in the area. Over the years, the bank expanded its services, including wealth management, commercial lending, and private banking.

For more than a century, Wellesley Bank thrived by maintaining strong relationships with its clients. Its emphasis on community values and high-quality customer service made it a cornerstone of financial stability in Wellesley and surrounding areas.

What Led to the Transition?

Shifts in the Banking Industry

The banking sector has experienced rapid consolidation in recent years. Regulatory pressures, increasing competition, and the need for technological advancements have driven smaller banks to merge with larger institutions. These consolidations often aim to leverage resources, expand service offerings, and remain competitive.

Wellesley Bank was not immune to these industry trends. Despite its strong local presence, the bank faced challenges in scaling its operations to compete with larger, more technologically advanced institutions.

The Cambridge Trust Acquisition

In 2020, Cambridge Trust, a prominent New England-based financial institution, announced its acquisition of Wellesley Bank. This marked a significant turning point in Wellesley Bank’s history. The merger allowed Cambridge Trust to expand its footprint into the Wellesley area while providing Wellesley Bank customers access to enhanced financial services, including robust wealth management offerings.

This acquisition sparked the question, “Did Wellesley Bank go out of business?” While Wellesley Bank ceased to operate under its original name, the institution’s legacy and services continue under the Cambridge Trust brand.

What Does the Transition Mean for Customers?

Continuity of Services

For Wellesley Bank customers, the transition to Cambridge Trust brought continuity rather than disruption. All branches of Wellesley Bank were rebranded as Cambridge Trust locations, and existing accounts were seamlessly migrated. Customers gained access to Cambridge Trust’s expanded resources, including advanced digital banking tools and a broader range of financial products.

Enhanced Wealth Management

Cambridge Trust is well-regarded for its wealth management services, and the merger brought significant benefits to Wellesley Bank clients. By joining forces, the institutions enhanced their ability to provide tailored investment strategies, estate planning, and financial advisory services.

Community Commitment

Despite the rebranding, Cambridge Trust has pledged to maintain the community-focused values that were central to Wellesley Bank’s identity. The merged entity continues to support local initiatives, charities, and economic development in the Wellesley area.

Analyzing the Merger’s Impact

Financial Stability

The merger strengthened the financial stability of both institutions. For Wellesley Bank, joining forces with Cambridge Trust provided the capital and resources needed to navigate the evolving banking landscape. For Cambridge Trust, the acquisition bolstered its presence in affluent markets, creating new opportunities for growth.

Customer Sentiment

Initially, some Wellesley Bank customers expressed concerns about the merger. However, many have since appreciated the expanded services and improved technological capabilities. Feedback from clients highlights satisfaction with Cambridge Trust’s commitment to preserving the personal touch that defined Wellesley Bank.

Challenges in Transition

While the merger brought numerous benefits, it was not without challenges. Some customers experienced temporary disruptions during the integration process, such as changes to account numbers or unfamiliarity with new online platforms. However, these issues were swiftly addressed by Cambridge Trust’s customer support team.

Understanding the Broader Context

Industry-Wide Consolidation

The story of Wellesley Bank is part of a larger trend in the banking industry. Small and mid-sized banks across the country are merging with larger institutions to stay competitive. Factors such as regulatory compliance costs, the rise of fintech, and shifting consumer expectations have accelerated this trend.

The Role of Technology

Technology has become a critical factor in banking success. Larger institutions can invest in cutting-edge digital solutions, offering customers features like mobile deposits, online account management, and fraud detection. The merger allowed Wellesley Bank to leverage Cambridge Trust’s advanced technology infrastructure, providing customers with a more seamless banking experience.

Dispelling Misconceptions

One common misconception is that Wellesley Bank “failed.” This is not the case. The bank’s transition to Cambridge Trust was a strategic move aimed at ensuring long-term success and sustainability. Rather than closing its doors, Wellesley Bank evolved to meet the demands of a changing financial landscape.

What the Future Holds

Cambridge Trust’s Growth Strategy

With the acquisition of Wellesley Bank, Cambridge Trust has positioned itself as a leading financial institution in New England. The company plans to continue its growth strategy, potentially acquiring other banks in the region to further expand its market share.

Opportunities for Customers

For former Wellesley Bank customers, the future looks promising. Cambridge Trust is committed to delivering personalized service while embracing innovation. Clients can expect ongoing improvements to digital banking, enhanced wealth management tools, and continued support for community initiatives.

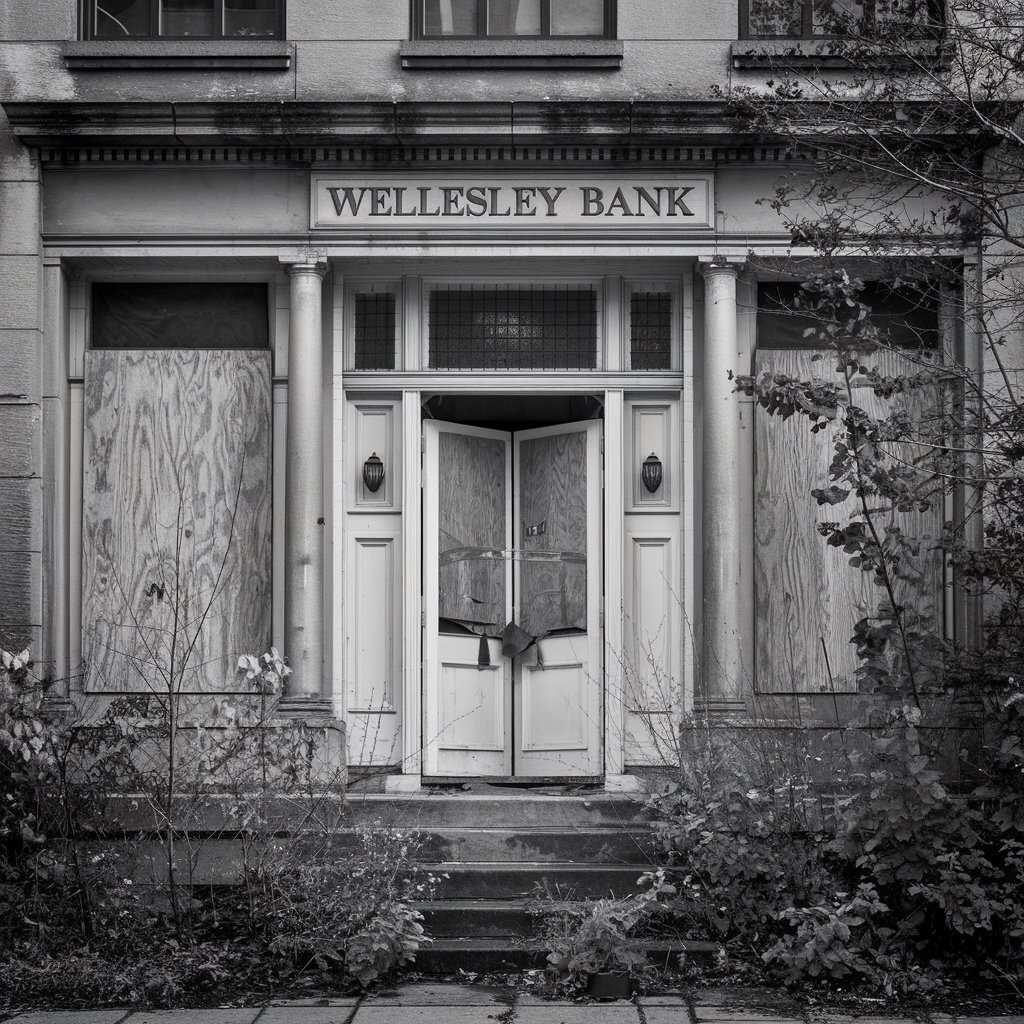

Legacy of Wellesley Bank

Though Wellesley Bank no longer operates under its original name, its legacy lives on through Cambridge Trust. The values of trust, community, and personalized service that defined Wellesley Bank remain central to the merged institution.

Conclusion

Did Wellesley Bank go out of business? While the bank no longer operates under its historic name, it did not fail or shut down. Instead, Wellesley Bank transitioned to Cambridge Trust through a strategic merger. This move ensured continuity for customers while providing access to enhanced services and resources. The story of Wellesley Bank is a testament to the evolving nature of the banking industry and the importance of adaptability in the face of change.

FAQs

What happened to Wellesley Bank?

Wellesley Bank was acquired by Cambridge Trust in 2020 as part of a strategic merger to expand services and enhance financial stability.

Who bought Wellesley Bank?

Cambridge Trust, a New England-based financial institution, acquvired Wellesley Bank in 2020.

Who bought Cambridge Trust?

Cambridge Trust has not been acquired and continues to operate independently.

Who is the CEO of Wellesley Bank?

Before the merger, Thomas Fontaine served as the CEO of Wellesley Bank. After the acquisition, leadership transitioned to Cambridge Trust’s team.

Who is the CEO of Left Bank?

Left Bank’s CEO varies based on the specific entity or region referred to, as there are multiple institutions using this name globally.

Who are the Wellesley companies?

Wellesley companies include various businesses in the Wellesley, Massachusetts area, spanning industries like finance, retail, and services.

What is happening with Wellesley?

The Wellesley area continues to thrive, with the former Wellesley Bank now operating under the Cambridge Trust brand.

Who is the owner of Wellesley?

Wellesley Bank is now owned by Cambridge Trust following the 2020 merger.

Does Wellesley have business?

Yes, the region of Wellesley remains a vibrant hub of business activity, and Cambridge Trust serves the financial needs of the community.

Is Wellesley worth it?

Wellesley is considered a desirable location due to its strong community, excellent schools, and high standard of living.

Is Wellesley public or private?

The town of Wellesley is a municipality. If referring to Wellesley College, it is a private institution.

How expensive is Wellesley?

Wellesley is one of the more affluent towns in Massachusetts, with higher-than-average property prices and living costs.